A lot remains to be done to significantly reduce the number of people who wake up every day hungry and malnourished – today that is over 700 million men, women and children.

Outside of tackling the increasing amount of conflict across the globe, responsible for extremely high levels of hunger and poverty in countries like Yemen, reducing hunger – as looked at in detail in ‘tackling hunger in the 21st century’ – will require:

- A sustainable increase in food production, reducing deforestation and greenhouse gas emissions

- An increase in food network resilience to conflicts and natural disasters

- A reduction in poverty and food insecurity, particularly focused on rural areas and agricultural income with 80% of the world poor living in rural areas & 60% working in agriculture

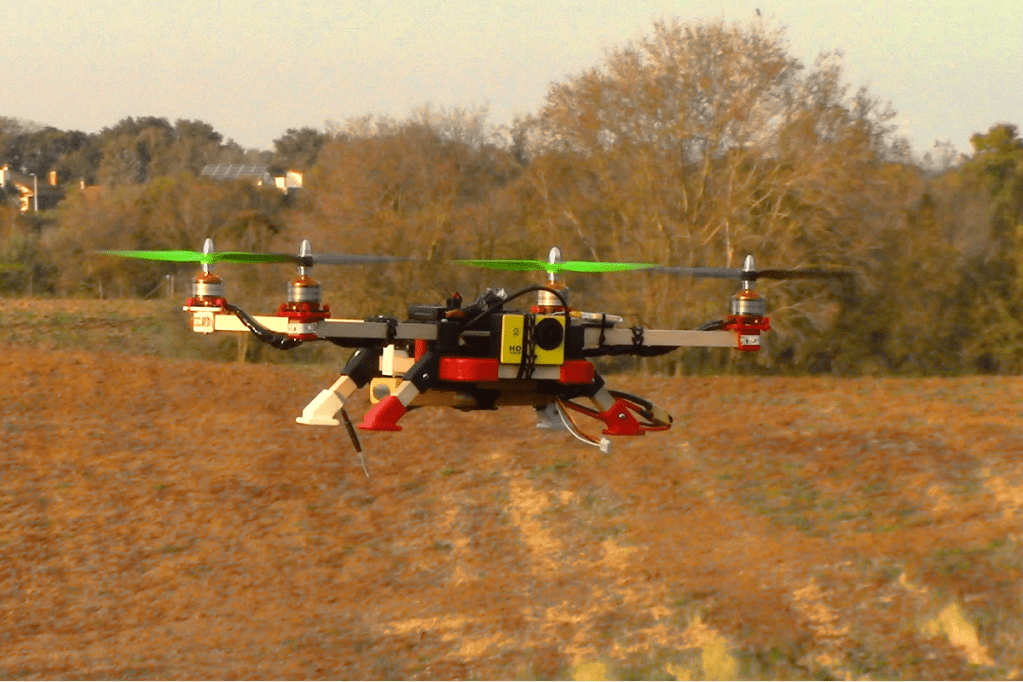

A major transformation in food systems is needed to achieve this, through fundamental changes in how we produce, distribute and consume food globally. Innovation and advanced technologies, driven by a wave of new ‘Agritech’ startups is our best chance at achieving this, from biotechnologies producing more resistant crops to robotics and AI improving yields and reducing waste.

Investment Trending Up

3 years ago, a 2018 report by the World Economic Forum & McKinsey outlined that $14 billion in investments in 1,000 food systems-focused start-ups had been made since 2010. This is a value that ultimately lags significantly behind investment in start-ups in other industries, with healthcare seeing $145 billion in investment in 18,000 start-ups over the same 8 year period.

However, Agritech startup investment has increased dramatically in the last 3 years, averaging $20bn a year globally in that time, with continued growth in 2020 despite the COVID-19 pandemic. This includes investment from upstream (closer to the farm) through to downstream (closer to the consumer).

Of the $25bn invested in Agritech startups in 2020, 50% was in downstream startups focused on restaurant and in-store technology, 20% in midstream covering logistics, transport and food safety, and 30% upstream with investments in farm robotics, bioenergy, novel farming systems, and innovative food.

This upstream investment has seen an array of modern technologies that are both enabling sustainable growth in food production as well as starting to transform the traditional agricultural landscape. On the data side companies like Farmers Edge and Verigo are increasing productivity on farms and minimising food waste between farm and retail, whilst companies like Reuters Market Light’s (RML) are making this technology more accessible to rural smallhold farmers by providing personalised agricultural data analytics via an app / SMS. In the genetics space, crops are being made increasingly resilient and less resource intensive by companies like Caribou biosciences.

Regional Disparity

Whilst investment is growing, it remains largely skewed towards more developed nations with over 95% of global investment in the USA, Europe and Asia (predominantly China). Africa and the Middle East see a significantly lower number of deals and with Africa, in particular, having a number of nations where ~50% of the population are malnourished as well as holding so much potential for solutions to the world’s hunger problem, there remains a lot of room for improvement.

Africa’s potential to play a key role in reducing the level of hunger is not a surprising one,with 60% of the world’s unused arable land and 54% of Africa’s population working in the agricultural sector, but technology driven innovation comes with challenges that African startups must overcome to see success and investment rise.

Startups with innovative business models, utilising modern technology, often need support through partnerships that offer more than just funding, including an expertise in the relevant technology sector such as AI and an understanding of the region. Finding the right partners, whether a Venture Capital firm or through funding programmes, with the right expertise and appetite to invest in African startups remains a challenge – but this too is trending in the right direction.

Funding opportunities are growing with programs, like the The Global Agriculture and Food Security Program (GAFSP) which has invested $311 million in 61 investment projects aimed at benefiting small- to medium-sized enterprises and smallholder farmers around the world. Meanwhile, in a similarly positive note for the development of skills and expertise in modern tech, the number of active tech hubs across Africa are on the rise with around 500 active hubs, many in Sub-Saharan Africa.

There is a long way to go on the journey to sustainably increase food production, increase food network resilience and reduce food insecurity, but the Agritech investment to help do so is starting to come and is heading in the right direction.

Sources:

http://www3.weforum.org/docs/WEF_Innovation_with_a_Purpose_VF-reduced.pdf

https://www.weforum.org/agenda/2019/08/africas-agritech-start-ups-could-be-the-next-jumia/

http://www3.weforum.org/docs/WEF_Incentivizing_Food_Systems_Transformation.pdf

https://www.2030vision.com/news/re-thinking-the-future-of-food-systems

Leave a comment